Leaders in Finance AML Europe 2023

Speakers

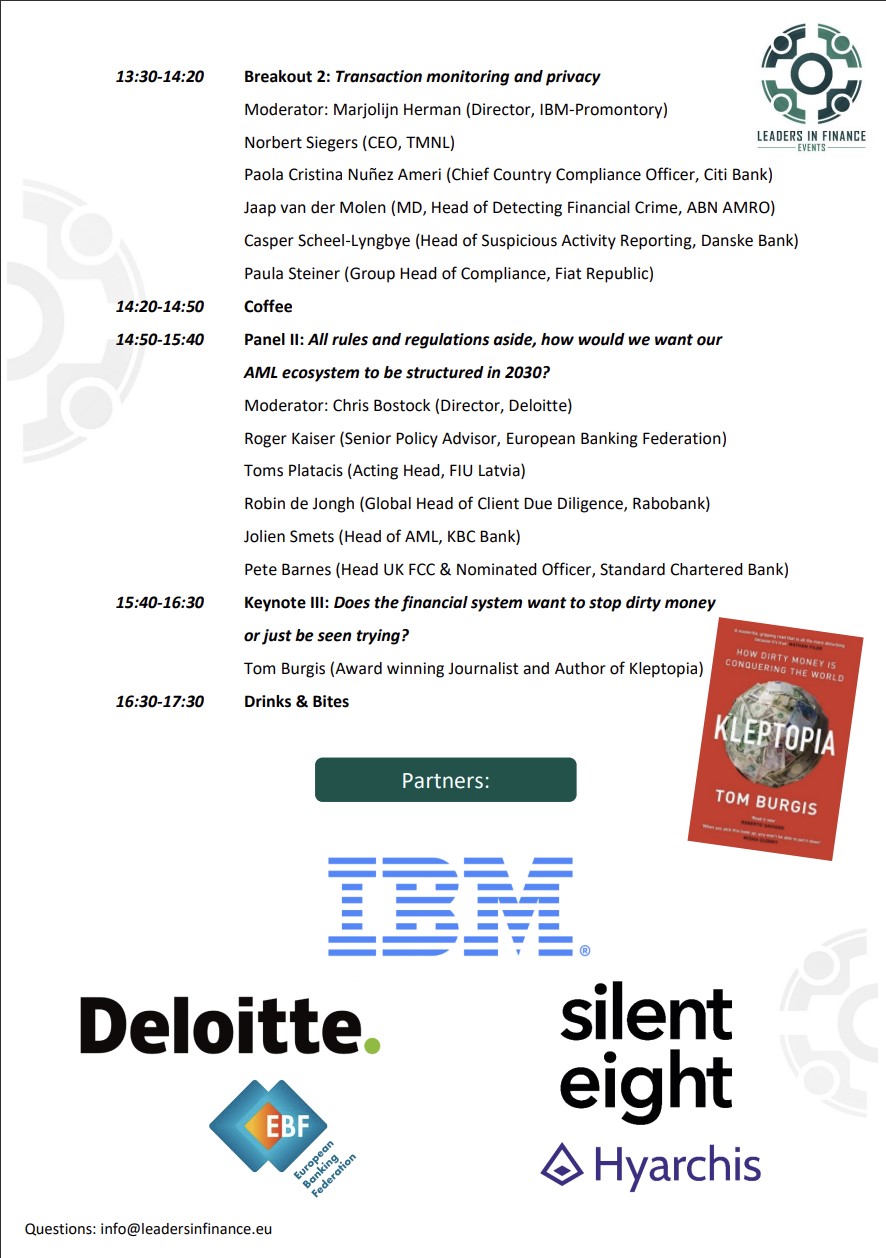

Partners

Pre-event interviews

*** Jolien Smets – Head AML KBC Bank ***

“We will also have to take the new ways of money laundering into account. I think as a financial institution we play a big role in the whole process, also in trying to discover new typologies. For example, if you take crypto coins; crypto is becoming more and more regulated, so I think it’s quite possible that there will be a shift towards even newer technology, like Metaverse or whatever else is coming. And in that case, I think there is also a need for speed, if I can phrase it like that, both from financial institutions but especially from regulatory bodies.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-jolien-smets/

*** Roger Kaiser – Senior Policy Advisor European Banking Federation ***

“As the European banking sector we are quite concerned about two issues. I have mentioned one, which is truly a stumbling block: the data protection issue. This is an element that is absolutely key, and over the last few weeks there has been some developments which are in my view highly problematic, due to what I would characterize as a dogmatic approach among data protection authorities. Of course, I fully understand that data protection is a fundamental right for citizens, but we must also strike a balance between this fundamental right and citizens’ fundamental right to live in security – as money laundering is a highly important threat to society. In my view, data protection authorities should understand this and be more flexible.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-roger-kaiser/

*** Tom Burgis – Award winning journalist (FT / The Guardian) and author of a.o. books Kleptopia ***

“I am a failed poet who ended up in South America about twenty years ago working at a tiny newspaper called The Santiago Times, when the former dictator in Chile, Augusto Pinochet, was being found to have been not only a brutal ruler, but also a kleptocrat who had secret accounts in Washington. It was at that moment that I became interested in corruption, and it just got deeper and deeper when I lived in Africa as a foreign correspondent for the Financial Times. And then writing books, chasing dirty money all over the world, including through the former Soviet Union. And now I am working on a third book, while also being on the investigations team of The Guardian in London.”

“The evidence suggests that attempts to vet clients for dirty money have very little effect on the data that you take. So if you are a crook, your likelihood of being stopped by the KYC-system is not that different from the likelihood of being stopped if you are not a crook.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-tom-burgis/

*** Chris Bostock – Director in Deloitte’s Financial Crime team in London ***

“People often think that fighting crime more effectively means spending more money. I do not think it necessarily does. If you can find the right ways to get the right information in the hands of the right people, and give them the tools and the technology and the systems… and the right legislative framework to work in, then you could deliver the outcomes we are delivering now for less money.”

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-chris-bostock/

*** Dan Margetts – Global Head of TM Transformation ING ***

“Now the cost of technical compliance is priced into business models, we are seeing a divergence of views where there’s one side of the house that’s saying: “Surely, we’re done”. And the other side of the house is saying: “Technically, we’re compliant, but there’s a better way of doing things. Not only is technology offering opportunities to be more effective, but also more efficient and to take out cost.” We’re also beginning to see a move by the regulators to support different ways of doing things. There’s a lot more language around taking a risk-based approach and using advanced technologies to become more effective, so the banks and public bodies can allocate their resources in a better way. “

Read the full interview here: https://www.leadersinfinance.nl/pre-event-interview-dan-margetts/

Audience

This Leaders in Finance European Event is about Anti Money Laundering. The event should be of great interest to leaders in the financial services industry (involved in the fight against money laundering and terrorist financing) as well as AML partners in the chain of organizations working in the field, both governmental and private actors. Officers are: managing directors, directors, managers and teamleads.

With this event we have a clear mission and focus on achievements!

First, we want to bring the (financial) professionals in the European AML space together and to facilitate knowledge sharing.

Secondly, we hope to add value in the deepening of cooperation between the different stakeholders in the AML chain of involved organizations, among other things, by facilitating the forming of new relationships and to deepen existing relationships.

Finally, above all we want to achieve that all participants will travel home after the conference full of energy and enthusiasm

Venue

Leaders in Finance Events

Email: [email protected]